The working world

Sections

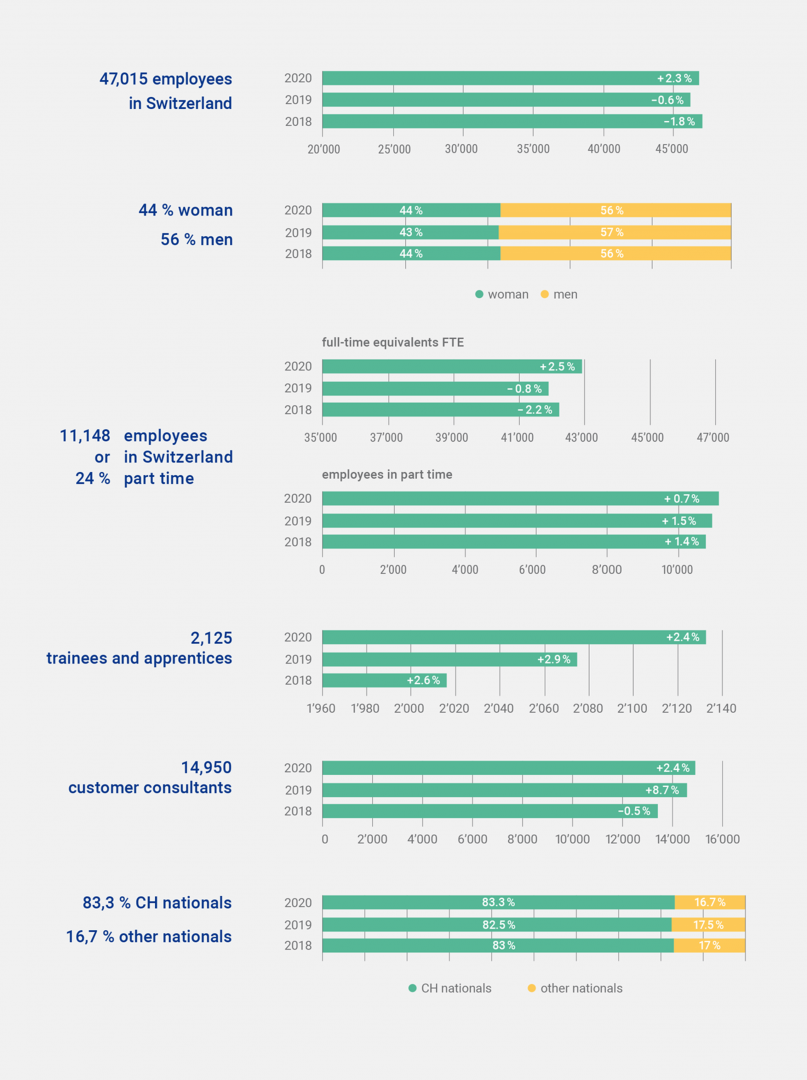

Private insurers provide jobs for more than 47,000 people and train over 2,000 young people in various occupations every year (GRI 103-1). The industry association’s annual employment statistics show the composition of the workforce and the changes compared with previous years (GRI 103-1):

The insurance industry wants to continue to be attractive for employees in the future. The SIA is therefore committed to promoting diverse, inclusive and thus sustainable cooperation and to making the most of the positive aspects of this diversity.

The Strategy 2020-2024 describes education and liberal labour market policies as the pillars of the industry’s competitiveness (GRI 103-2). In order to ensure high quality training, the SIA identifies future-oriented job profiles and promotes suitable training courses. For example, it is committed to strengthening the dual system of vocational education. As well as a high degree of permeability, this ensures a diverse range of training opportunities and attractive professional development opportunities.

Promoting mixed teams

The insurance industry wants to remain attractive to employees in the future. As a result, the SIA is therefore committed to promoting diverse, inclusive and thus sustainable collaboration, and to making optimal use of the positive aspects of this diversity. SIA works with the Competence Centre for Diversity and Inclusion at the University of St. Gallen (CCDI-HSG) and has a benchmarking report prepared on a regular basis. The SIA also supports Compasso. The employers’ organisation offers guidance and assistance to help companies deal with employees facing health problems. Among other things, Compasso shows employers how exits from the primary labour market can be avoided as far as possible, making it easier to maintain or regain employability. At the company level, there is also a wide range of initiatives, programmes and events to promote diversity and inclusion.

The working world of tomorrow

The working world is changing at a rapid pace. External factors such as the COVID-19 pandemic have accelerated this development even further. In this context, the SIA with its member companies has identified future fields of action for the working world of tomorrow. For example, both employers and employees are increasingly exploiting and valuing the advantages of location-independent work and forms of work such as the home office and remote/mobile working. By reducing commuting and travel, which in turn reduces the carbon footprint, location-independent forms of work make a far from insignificant contribution to sustainable mobility. In order to further promote the efficiency and effectiveness of this mobile collaboration, insurance companies have made targeted investments in digitalisation in recent years.

Skills of the future

With the Institute of Insurance Economics (I.VW) at the University of St Gallen and the Swiss Federal Institute for Vocational Education and Training (SFIVET), the SIA has published the ‘Skills of the future’ study, the aim of which is to identify coming trends and changes in the insurance industry between now and 2030. Based on the changes expected, the study analysed which skills will be required for the new activities in the future. The report will be used by insurance companies to ensure targeted vocational education and training for their employees. The SIA will also use the report to review vocational training profiles based on the trends researched and the skills required. The Association for Professional Insurance Education (VBV-AFA) has also addressed this issue and is incorporating the findings into current reform projects such as ‘Kaufleute 2022’ and into the further development of vocational training and the VBV insurance intermediary examination.

Support of young talent

The evaluation of skills and subsequent review of vocational training programmes are closely linked to the issue of promotion of young talent (GRI 103-1). After all, sustainability relates in particular to the support of future generations. Only if they are involved early enough will be possible to find a sufficient number of good and suitable employees in the long term. For companies and the industry as a whole, apprentices are an investment in the future that should not be underestimated. During the COVID-19 pandemic in particular, many insurers actively invested in vocational training by maintaining or expanding their range of apprenticeships and continuing to employ the graduates as far as possible (GRI 103-1).

In order to showcase the industry’s appeal and the training opportunities available in the insurance industry, the SIA launched the startsmart.ch platform in spring 2020. The ‘Berufsfinder’ tool and the associated platform are designed to help young people find a suitable apprenticeship in the insurance industry.

The development processes are a good way of systematically establishing sustainability aspects in insurance-specific vocational training. These are coordinated via the VBV.

Sustainability Report 2020

-

Foreword

Read more

-

Management summary

Read more

-

Committed to sustainability

Read more

-

Insurers assume social risks

Read more

-

Method and definition

Read more

-

Investment

Read more

-

PACTA 2020: the lessons learned from the climate compatibility test

Read more

-

Retirement provision

Read more

-

The working world

Read more

-

Corporate Environmental Management

Read more

-

Impact of climate change

Read more

-

Collaboration for sustainable development

Read more

-

Appendix

Read more