Insurers on the fast track?

The news agency Reuters sees insurers overtaking banks in the near future: As 2018 growth rates of the two industries indicate, insurers are set to make a larger contribution than banks to the CHF 660 billion Swiss economy.

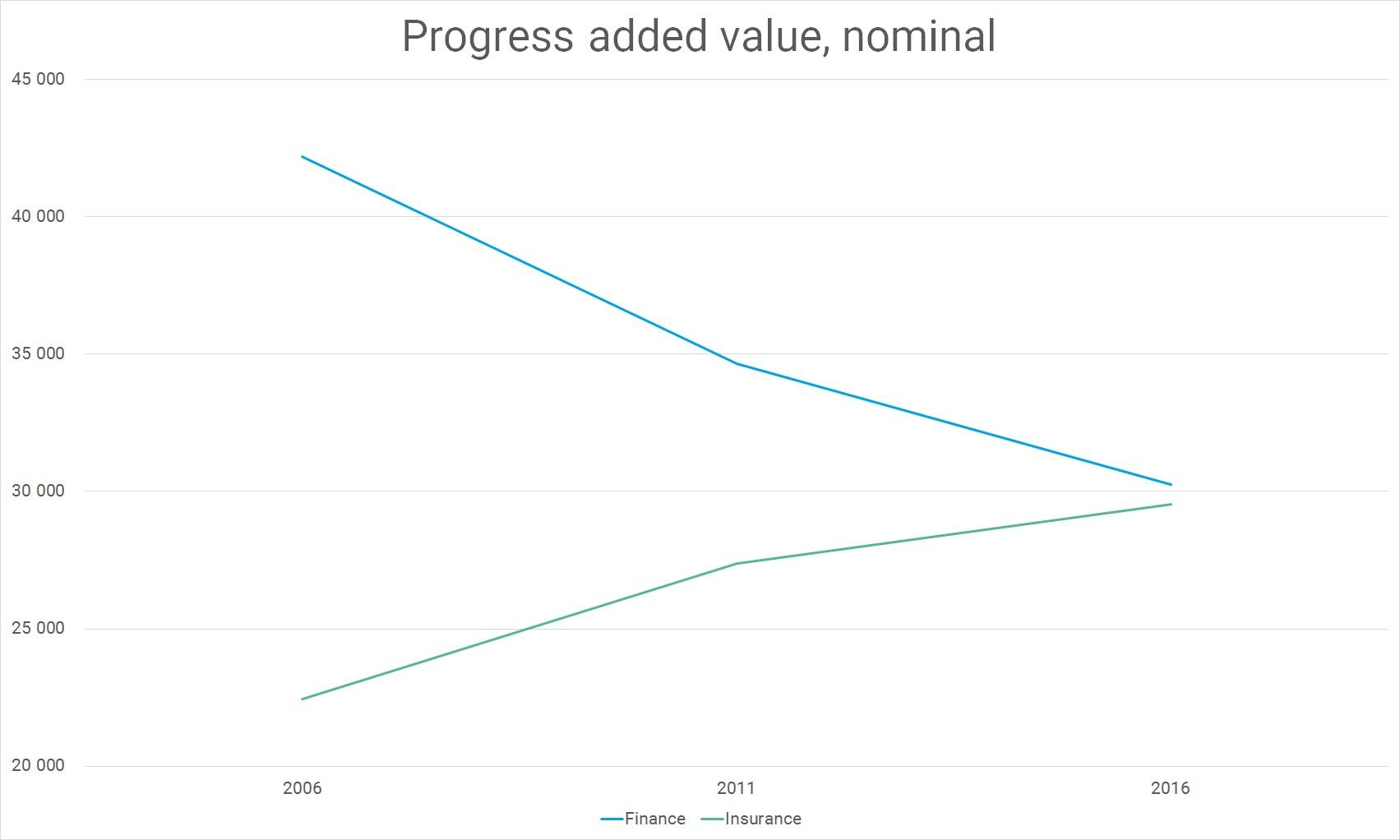

Source: BFS/SECO

The Swiss State Secretariat for International Financial Affairs (SIF) concurs: In its 2017 Key figures Swiss financial centre the SIF shows that the insurance industry’s economic contribution for 2016 amounts to CHF 29.5 billions, with the banks are only slightly ahead (CHF 30.3 billion). In 2006 the picture was quite different: The banks then contributed CHF 42 billion to Switzerland’s gross domestic product (GDP) – nearly twice as much as the insurers with CHF 22 billion.

A stable industry

The onset of the subprime crisis in 2008 put the insurance industry onto the fast track. During the crisis insurers had a stabilising influence on the Swiss financial markets.

In the wake of the dotcom bubble, the industry had to deal with profound structural change leading to massive reorganisation at the beginning of the millennium. Its efficiency has increased ever since. Moreover, insurers’ business models tend to be oriented towards the long term and therefore less volatile. These characteristics were among the main drivers for the above-average growth of the insurers’ GDP contribution.