Pandemic insurance cover: Not without a public-private partnership

Population growth, global mobility or ecological changes increase the risk of pandemics. Is pandemic risk insurable? The answer is, only with governance participation.

By Michaela Bruer und Angela Zeier Röschmann, Institute of Risk & Insurance at the ZHAW School of Management and Law

A pandemic is, according to the risk and hazard analyses carried out by the Federal Office for Civil Protection, one of the biggest risks that exists in Switzerland apart from a protracted power failure and a major earthquake. Now the risk of a pandemic has materialized in the form of Covid-19, with profound consequences for our society and economy. The insurance industry estimates that the risk of pandemics is increasing. The reasons for this are population growth, global mobility, ecological changes and increased interaction between humans and animals. The question is therefore not whether Switzerland will experience another pandemic - but when, and to what extent.

The epidemic insurance covers offered up to now were not designed for the risk of a pandemic, a fact which is understandably resulting in disputes at the moment. What is needed is for insurers to refine their conditions and communications with regard to the difference between a pandemic and an epidemic in order to ensure security and clarity for both parties.

The problem is the simultaneity

The question why a pandemic is a risk that is difficult to insure can be answered by looking at the difference between a pandemic and an epidemic. Epidemics and normal waves of influenza, which include seasonal waves of influenza as well as the appearance of new types of viruses with the potential to turn into pandemics, are limited in terms of time and space. In contrast, it is characteristic of a pandemic that it by definition spreads globally across continents and that certain parts of the population are exposed. For insurers, this means that they are liable to pay benefits from different lines of insurance at the same time. These can be e.g. life insurance, event cancellation, business interruption, travel or credit insurance. However, a decisive feature for the functioning of the basic principle of insurance, namely the balancing effects of risk pooling, is that the risks to be insured are independent of each other. Independence means that not all members of a group will be affected by a risk at the same time and expect payment and assistance from the insurer within short notice in the event of a claim.

An epidemic or severe storm also makes large numbers of sometimes high payments and assistance necessary, but they can be diversified in terms of geography and time because such events do not usually occur simultaneously. This is not the case with a pandemic, which is of course characterised by its very spread. Because pandemics are rare but will occur over a period of 30-50 years, insurers must make sure that they have an adequate infrastructure for processing claims as well as sufficient capital resources and capital saved up. A pandemic is typically accompanied by turbulence in the financial markets, putting a strain on the assets needed to cover losses and impending liabilities to policyholders.

These correlated developments accentuate the limits of insurability. A comparison: The Swiss insurance industry as a whole writes premiums, according to figures from the Swiss Financial Market Supervisory Authority, of around CHF 114 billion per year in the life and non-life lines and in reinsurance. The KOF Economic Research Institute put the cost of the pandemic to the Swiss economy between March and June at CHF 35 billion. Insurers cannot shoulder losses of this size on their own. The premiums for customers would be unaffordably high or the industry itself would go bankrupt during the next pandemic. The conclusion that can be drawn is that a pandemic overburdens the capacity of both an individual insurance company and the industry as a whole.

Every pandemic is different

Another key condition for a risk to be insurable is that it can be priced. The degree of uncertainty regarding impact and frequency is high, however. Every pandemic is different with regard to the course of the disease and the mortality rate, the speed at which it spreads, the groups of people affected, its duration, the availability of measures such as tests, cures and remedies, and measures taken by the government such as travel restrictions or closure of businesses. As pandemics are rare, insurers cannot avail themselves of sufficient data to price pandemic risks as opposed to the assessment of fire or accident risks. Insurers therefore use models to simulate the main characteristics of a pandemic with different scenarios. There are a number of mathematical epidemic models which describe the possible course of an infectious disease and now also take account of measures introduced by the state and society and their influence on the course of an epidemic or pandemic.

Limited demand

The insurability of a risk can be systematically determined by means of several criteria, three of which have already been discussed above: independence, manageability of the maximum possible loss and quantifiability. Berliner (1982) specified a number of criteria to assess whether a risk is insurable. Figure 1 discusses the characteristics of the risk of a pandemic based on these criteria. The analysis shows that, apart from actuarial criteria, also market-related criteria are scarcely met. For the formation of an insurance collective, a sufficient number of insureds is required. However, there is only little demand for pandemic insurance, and usually only after events causing media attention. Moreover, as insurers would have to charge very high premiums in order to cover pandemic risks and would have to limit the cover considerably so as to be able to keep their promise with a very high degree of certainty, there are hardly any attractive offers on the market.

1

The event is unforeseeable

and cannot be influenced

as to probability and extent.

The probability and

extent of the risk can be

quantified.

When it will occur and what effects

it will have are uncertain.

The effects are influenced

by measures taken by the state.

The recurrence periods of pandemics

are high so that there is a high

diagnosis risk (see also No. 5).

2

The events are independent

of each other (no accumulation).

A pandemic is characterised by its

global spread and correlation

with financial market turbulence.

A diversification is hardly possible.

3

The maximum possible loss

is manageable, i.e. the highest

possible insurance benefit

payable by an insurer

does not exceed its capacity.

A pandemic can make

high loss payments necessary

within short time.

Therefore, in addition to

the infrastructure, very high

capital reserves must be

maintained and liquid funds

must be available at short notice.

4

The average loss

is moderate.

The average loss can usually

be limited by the terms and

conditions and sublimits.

The question is whether limiting

terms and conditions are enforceable.

5

The loss frequency is

high and the event occurs

relatively often.

There have only been few

global outbreaks (e.g. Spanish flu, SARS),

so that there are hardly any

empirical values from the past.

Moreover, general conditions are

changing (e.g. medical progress).

6

The asymmetry of information

between insured and insurer

is not excessive, moral hazard

and adverse selection are low.

Protection against the risk

of a pandemic is more in

demand from exposed sectors

(adverse selection). The risk of

insureds changing their behaviour

after taking out insurance

(moral hazard) is not to be expected.

7

The insurance premium

is reasonable and affordable

so that there is a market.

The premium is high owing

to the above-mentioned characteristics

and demand is rather low or seasonal.

8

The coverage limits

are acceptable.

Coverage usually depends on

requirements (e.g. business continuity)

and is tightly constrained (e.g. limits, deductibles)

because of the above-mentioned

characteristics.

9

The industry's capacity

is adequate, with sufficient

capital and liquidity

available to pay for

large claims within

a short space of time.

A pandemic is characterised

by its global spread,

which means that high,

simultaneous worldwide funding is required.

10

The insurance is consistent

with regulatory

policy and social acceptance.

An insurance is wanted, but also

involves the risk of state intervention

(e.g. prescribed goodwill).

The question arises whether

compulsory insurance is wanted

by society.

11

Coverage is legally permissible.

This criterion is fulfilled.

Figure 1: Assessment of the insurability of the pandemic risk against the criteria of Berliner (1982) Limits of Insurability of Risks, Englewood Cliffs, NJ: Prentice-HallCover for extrem events

In order to extend the limits of insurability and coverage for extreme events, other risk financing instruments are needed. A glance at the financing of other catastrophe risks shows that such risks are often provided for by state-backed solutions. Switzerland, for example, has a so-called pool for the insurance of nuclear risks, in which private and public insurance and reinsurance companies based in Switzerland have joined up. In addition, Switzerland has a pool for natural perils such as high water, floods, storms, hail, avalanche, snow pressure, rockslide, rockfall and landslide, which makes the effects of such natural events more manageable. Before the state’s arrangements for natural hazard insurance, natural hazards were considered "uninsurable" because of their severe consequences.

Similar solutions for risks which are difficult to insure exist in other countries, for example, for terrorism and natural hazards, the "Extremus Versicherungs-AG" in Germany and "Gestion de l'Assurance et de la Réassurance des risques Attentats et actes de Terrorisme (GAREAT)" in France or the "National Flood Insurance Program (NFIP)" in the USA. These could be used as a starting point for considerations regarding a pool solution to cover pandemic events. Discussions are in fact already underway in various countries, including Switzerland, and project groups have been set up to develop possible solutions. According to Urs Arbter, deputy director of the Swiss Insurance Association, a project team has already been set up by the federal government and the insurance industry to draw up a report containing relevant conceptual options.

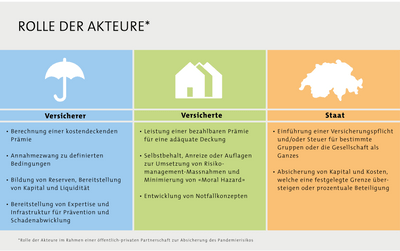

Public-Private partnership

In order to mitigate the financial effects of future pandemics, there is a call for a partnership between insurers, policyholders and the state. Broadly speaking, in such a partnership the insurers will process claims and pay benefits, the federal government will distribute the costs and guarantee funding of the most extreme cases, and the policyholders will pay deductibles and make provision by means of risk management (Figure 2). An insurance rider supplementing a business interruption insurance policy could be a suitable instrument. In the case of this insurance, the assessment of the amount of loss is based on the answer to the question "what a company would have earned if the pandemic had not occurred". However, the cause will not be a material damage such as fire, as it usually is, but a pandemic together with related measures taken by the government, such as ordered plant closures, restrictions for certain age groups, quarantine regulations or border closures. Defined risks could be covered by the private insurance industry in excess of a certain limit or in the form of a quota share. Public partnership is necessary in order to make the extreme scenario which is typical for pandemics manageable. Conceivably, the government could assume the role of co-insurer or reinsurer. Another conceivable option is securitisation of a share in the risk. Furthermore, so that the reserves required for a pandemic can be established, adequate premiums need to be earned. Only the state can ensure a sufficient distribution of the costs by means of a tax or insurance obligation. The question of whether selected sectors or society as a whole should contribute to the financing needs to be addressed.

Avoid wrong incentives

Moreover, no privileges or disadvantages may be created which could create false incentives or distort competition. At the same time, insurers would have to commit to accepting all insured persons at the same conditions. An insurance cover could, however, be tied to risk management requirements such as the existence of a contingency plan, diversification of supply chains or certain credit ratings. Insurers and reinsurers have many years of expertise in the assessment and management of business interruption risks. Risk management is practised by insurers not only for their own company, but also for their customers by providing advice and creating tailor-made insurance products. This know-how will contribute to a financing solution based on partnership. Insurers also have the infrastructure and necessary investment structures to make funds available quickly in the event of a loss. "Even given the extraordinary circumstances during the corona pandemic, insurers paid out around CHF 139 million a day to their customers for claims and pensions. They thus make an important contribution to their customers' solvency", comments the Swiss Insurance Association on enquiry.

Coverage has its price

A public-private insurance solution raises further questions, however. First and foremost, the question is whether society and/or the economy is prepared to pay the necessary price. Furthermore, it is unclear what share of the risk will be borne by private insurers. From the insurers' point of view, such involvement must be viable and profitable; at the same time, state participation in risk assumption must not lead to subsidies which distort competition. If the share of risk assumed by the insurance industry is too low compared to the state’s share, it is dubious whether the insurance industry should participate. This objection is based on the above-mentioned criteria of insurability. For although state participation will limit the maximum loss, it will not improve the problem of accumulation, absence of diversification or quantifiability. In addition, insurers have to maintain adequate reserves, which places a burden on their balance sheets.

Clear laws and rules

Moreover, a public-private insurance solution would presumably have to be regulated by law. In the past, the example of earthquakes has shown how complex such a process is to implement. To date, no national earthquake insurance has been set up in spite of broad support. Another issue is that appropriate insurance contracts would have to be drawn up. The triggers for benefit payments as well as the extent of liability must be defined on the basis of just a few empirical values in such a way that contractual security is achieved, because in the event of a pandemic, the government will take far-reaching measures to control its spread. It should therefore be avoided that uncertainty regarding liability to pay benefits under insurance contracts leads to government intervention. Some countries are currently discussing whether insurers should be forced to provide benefits despite a lack of coverage. In the case of a privately organised insurance company, payouts are always counterbalanced by premium income. Demanding a payout for uninsured risks would undermine both freedom of contract and the idea of solidarity and could lead to the insolvency of insurers and elimination of insurance cover for such risks.

The present article presents only a basic outline of the extent to which a hybrid solution of cost allocation and guarantee by the state and pricing and administering by the private sector could make pandemic insurance possible. Before a solution can be developed, many questions need to be answered. One argument in favour of an insurance solution is that the funds collected are returned to the affected companies in a more risk- and contribution-oriented sense.

The original article of this contribution was published on 1 July 2020 in the dossier “realities” of the university magazine Impact of Zurich University of Applied Sciences.