Affordable natural perils insurance thanks to the ES pool

Intended to optimise risk diversification and risk exposure, the Swiss natural perils pool (Elementarschaden-Pool, ES pool) is a joint enterprise by the 12 private insurers that cover over 90% of the natural perils market.

What is the natural perils pool?

This pool is a voluntary association of a number of private insurers intended to equalise risk among them. The ES-Pool enables its participants to offer natural perils insurance at a uniform and financially sustainable premium. This unique mutual assistance enterprise among insurance companies benefits those segments of the population with the greatest need of protection (such as the inhabitants of the alpine regions of Switzerland) from floods, avalanches and similar natural hazards. It was set up in 1936.

All member of the natural perils pool are bound to abide by the agreements between the pool and the communities concerned. Most insurers that are not members of the ES-Pool abide by them on a voluntary basis.

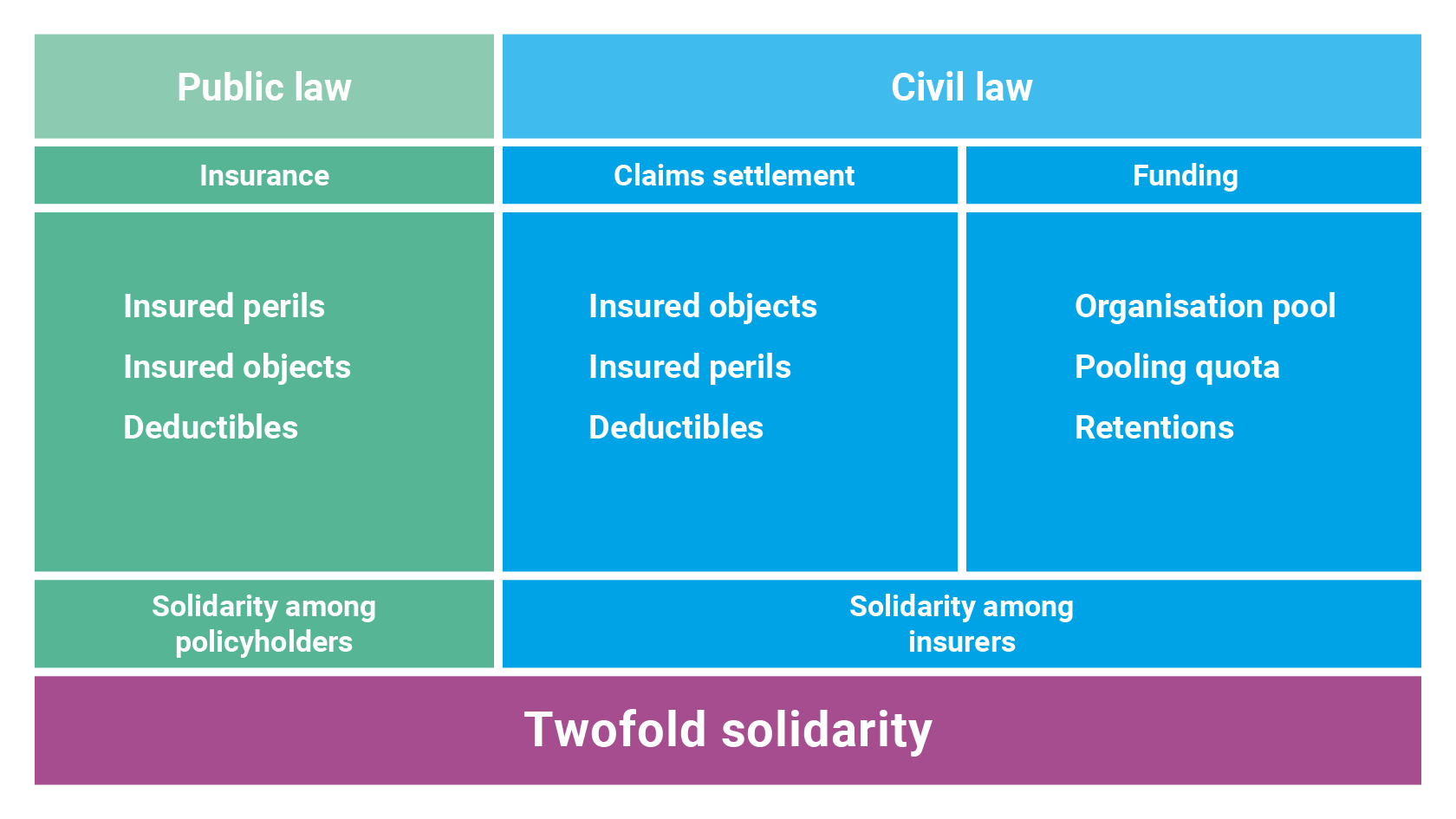

Twofold solidarity

Conceptually, natural perils insurance is based on twofold solidarity, as natural hazards are only insurable to the extent necessary and at sustainable premiums if both insurers and policyholders show solidarity and agree to jointly bear the associated risks. Otherwise, it would have been impossible to introduce any kind of natural perils insurance, let alone for it to become as popular as it is.

Solidarity among policyholders: The insurance tariff is identical for all holders of a natural perils policy. The law prohibits insurers from asking for higher premiums in regions that are at particular risk. The natural perils insurance premium for house-owners is set according to the value of the house, while its location is not taken into account. In high-risk areas, protection against natural hazards would otherwise become unaffordable. Due to the extensive solidarity among the less-exposed segments of the population and those that face major natural perils, this type of insurance becomes possible.

Solidarity among insurers: Losses due to natural hazards are spread among ES-Pool insurers according to their market share in Switzerland, thereby guaranteeing that risks in especially endangered regions remain insurable.

What is my natural perils coverage?

Natural perils coverage is included in fire insurance for buildings and chattels (business inventory, household contents). The corresponding legal basis can be found in art. 171 ss. of the Swiss Supervision Ordinance (AVO).

Which perils are covered?

Natural perils insurance covers damages and losses due to high water, floods, storms (i.e. Gales reaching at least 75 km/h that uproot trees or lift roofs in the vicinity of the insured objects), hailstorms, avalanches, snow pressure, rockfall, rock slides or landslides.

Damages such as ground subsidence, unsuitable subsoil, faulty design/construction, failure to take defensive measures and inadequate maintenance of the buildings concerned are excluded form coverage.

Who belongs to the ES pool?

At the moment, the pool consists of 12 private insurance companies that jointly cover over 90% of the market. Together, they form an ordinary partnership in accordance with art. 530 of the Swiss Code of Obligations.

In which cantons is private natural perils insurance available?

Private insurance companies provide cover for buildings in the cantons of Geneva, Uri, Schwyz, Ticino, Appenzell Innerrhoden, Valais, Obwalden (GUSTAVO cantons) and in the Principality of Liechtenstein, and they provide cover for business inventory and household contents, known as chattels, in all cantons (with the exception of Vaud and Nidwalden). There is a state monopoly for chattels in the cantons of Vaud and Nidwalden.

Where can I find further information?

Geschäftsstelle des Elementarschadens-Pools (ES-Pool Agency)

c/o Swiss Insurance Association (SIA)

Conrad-Ferdinand-Meyer-Strasse 14

8022 Zurich

Eduard Held is the managing director of the ES-Pool:

Tel.: +41 (44) 208 28 12

Email: eduard [dot] held svv [dot] ch

svv [dot] ch