PACTA 2020: the lessons learned from the climate compatibility test

Sections

The goal of the Paris Agreement is to reconcile financial flows with a low-carbon path (GRI 103-2). The Capital Transition Assessment (PACTA 2020)5 measures the progress made by the Swiss financial sector in terms of its contribution to reducing carbon emissions. PACTA 2020 was based on the climate compatibility test of 2017. The SIA supported the Swiss federal government’s initiative to create transparency in achievement of the goals set out in the Paris Agreement. A total of 24 insurance companies, which together account for 79 per cent of the capital invested by Swiss insurance companies, took part in this test. In addition to the investment portfolio, the real estate and mortgage portfolios of 16 insurance companies were also assessed for the first time. At times, understanding and interpreting the results proved to be a challenge. It is imperative that the method, process and presentation of results is developed further in future PACTA studies.

Financial investments

The analysis focused on those asset classes with the most direct and ideally verifiable impact on the real economy, for which public data is also available. These are direct investments in economic activities through the purchase of listed stocks and corporate bonds on the secondary market. The total market value of the portfolios submitted by the insurance companies came to approximately CHF 250 billion. Of this, 20 per cent are stocks and 53 per cent corporate bonds. The investments were made either directly or as part of a fund. These two asset classes were assessed in the study. The remaining 27 per cent relates to asset classes that have not yet been assessed as no suitable methods are available.

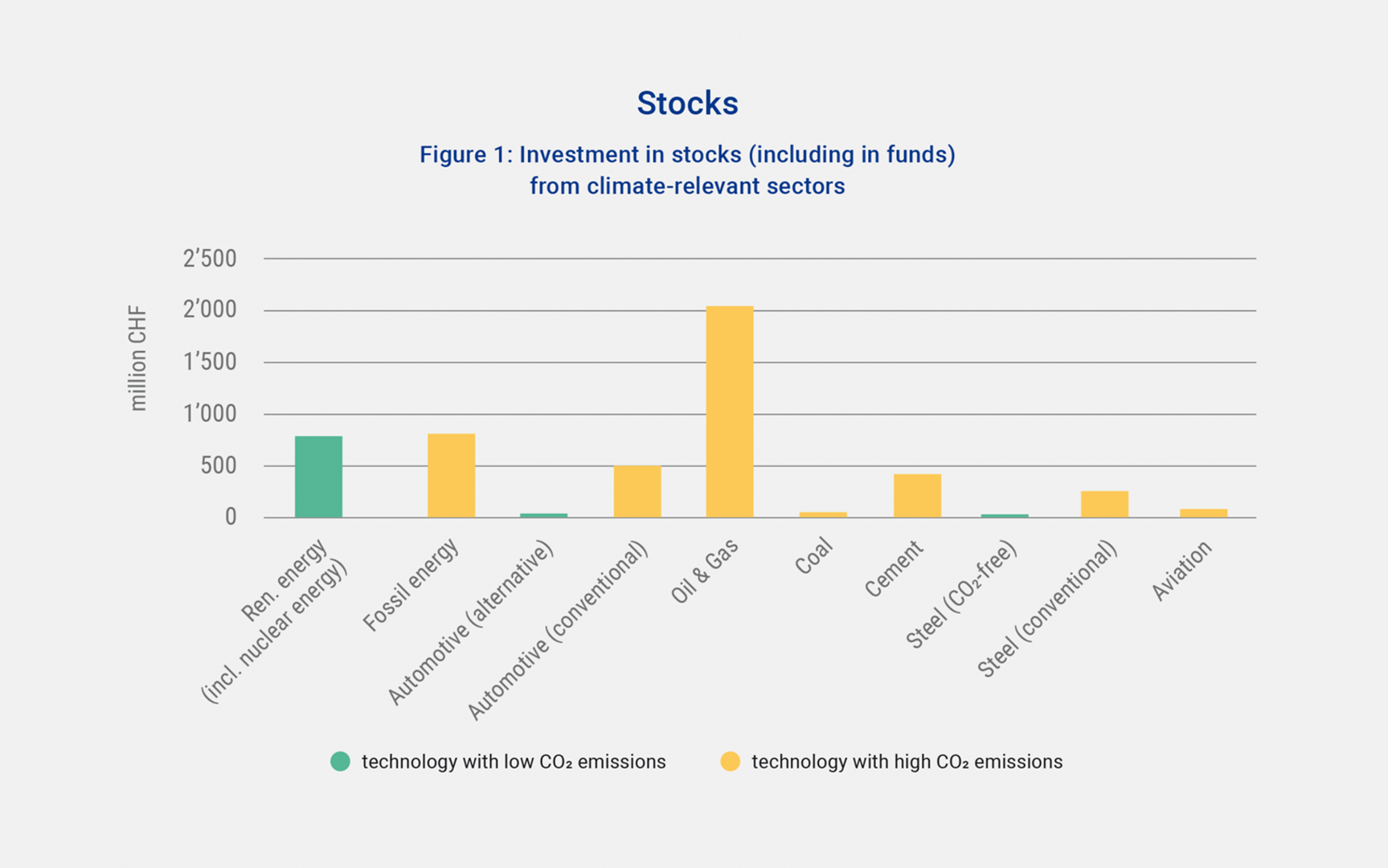

The analysis was restricted to those sectors with an impact on the climate (automotive production, including light and heavy commercial vehicles, aviation, coal mining, cement production, steel production, oil and gas production, power generation and shipping). These sectors represent 10 per cent of the industry portfolio in the survey, but are responsible for 74 per cent of CO2 emissions. For stocks, Figure 1 shows that in the field of energy production, the share invested in renewable energies is about the same as that invested in fossil energy production. With investment of just over CHF 2 billion, oil and gas extraction is the sector with the highest share of CO2 emissions. The shipping sector is not shown, as its share is negligible.

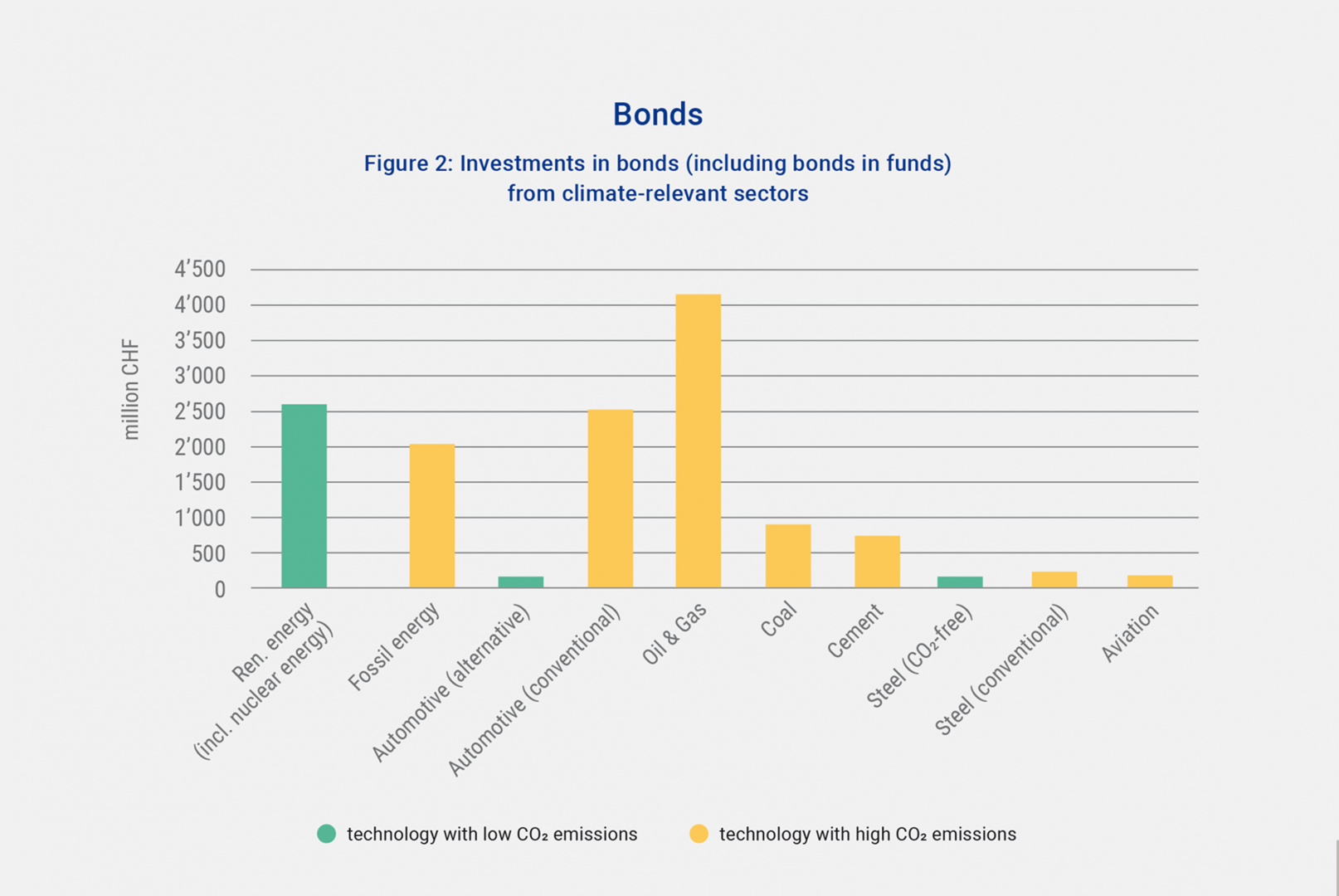

Compared with stocks, the proportion of investment in renewable energies in corporate bonds is slightly higher than that in fossil energy sources.

As with stocks, the oil and gas extraction sector dominates the carbon emissions data. The automotive sector accounts for a bigger share in this asset class than is the case with stocks.

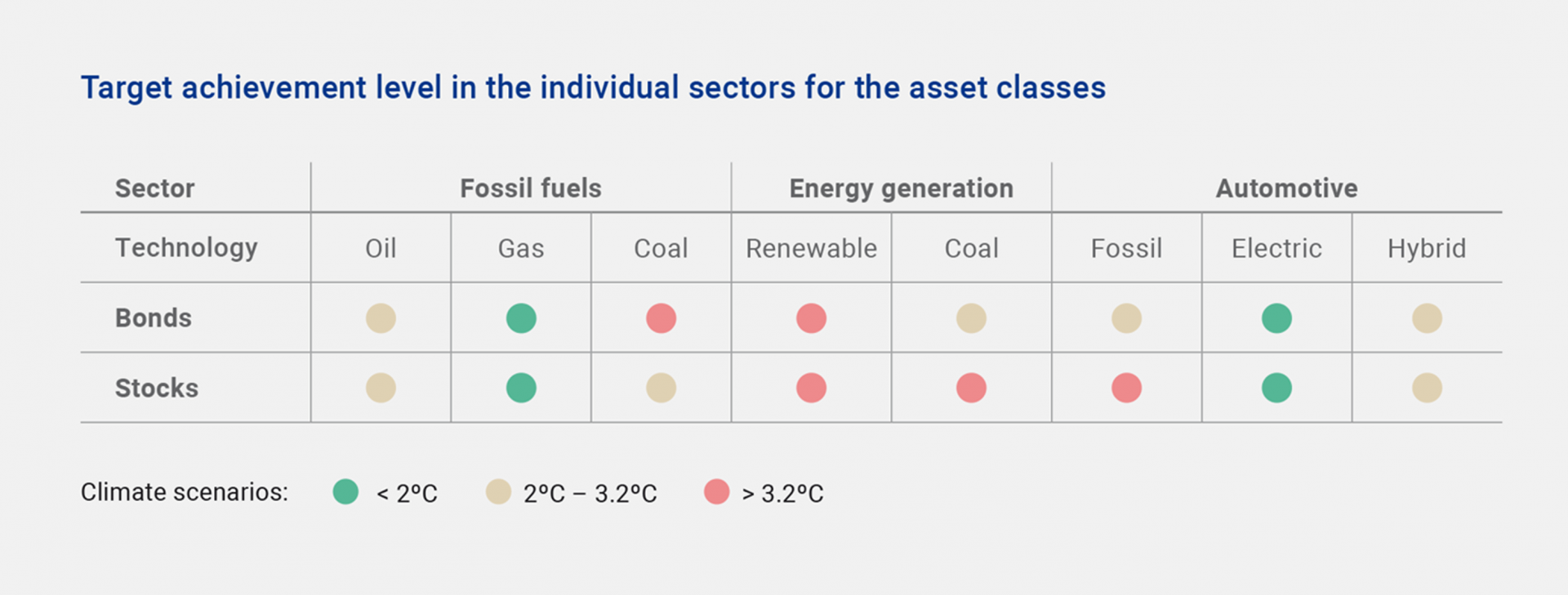

In order to assess the development of the portfolios over the next five years, an estimate was made for each company in the stock and investment portfolio as to how it will develop in terms of greenhouse gas emissions. This information was used to assess the climate impact for each sector in the portfolio and compared with the climate scenarios. A prerequisite for such a comparison is that the sector has a sufficiently granular reduction path derived from the climate scenarios. Suitable roadmaps are available for the electricity, coal, oil and gas and automotive sectors. As the analysis of the portfolio revealed, too little attention is paid to the environmental footprint, particularly when it comes to investment in the area of energy generation. Overall, it is still the case that too much is invested in fossil energy production and too little in renewable energy.

As the analysis of the portfolio revealed, too little attention is paid to the environmental footprint, particularly when it comes to investment in the area of energy generation.

Real estate

The PACTA 2020 report assessed the climate impact of the real estate portfolios submitted for the first time. In Switzerland, institutional investors own about 20 per cent of residential properties and approximately 10 per cent of commercial properties. Insurance companies assessed 7,263 buildings and eight mortgage portfolios.

According to the greenhouse gas inventory of the Federal Office for the Environment (FOEN), carbon emissions from Switzerland’s buildings currently account for just over a quarter of the country’s total carbon emissions. Newly constructed buildings are already largely equipped with renewable heating systems. However, the report shows that a significant proportion of older buildings held by all institutional property owners are still heated using oil or gas. Carbon emissions per square metre remain very high for buildings built before 1980 in particular.

The overall evaluation also shows that buildings directly owned by institutional owners emit less CO2 per kg/m2 on average than the rest of the building stock. According to the analysis presented in the methodology report, CO2 emissions of Switzerland’s entire building stock average 34.5 kg/m2. The median carbon emissions for all directly used buildings came to 15.2 kg/m2 in 2020. Taking the renovation measures planned by the participants over the next 10 years into account, this value drops to 11.5 kg/m2, which would correspond to a reduction in total CO2 emissions of 9 per cent a year. Thus, in the segment of directly held properties the current climate compatibility result can be described as good.

5 Bridging the gap, measuring progress on the climate goal alignment and climate actions of Swiss financial institutions, Report November 2020; 2ii, wüestpartner und Pacta

Sustainability Report 2020

-

Foreword

Read more

-

Management summary

Read more

-

Committed to sustainability

Read more

-

Insurers assume social risks

Read more

-

Method and definition

Read more

-

Investment

Read more

-

PACTA 2020: the lessons learned from the climate compatibility test

Read more

-

Retirement provision

Read more

-

The working world

Read more

-

Corporate Environmental Management

Read more

-

Impact of climate change

Read more

-

Collaboration for sustainable development

Read more

-

Appendix

Read more