BAK Study 2022: Economic importance of the Swiss financial sector

The financial sector remained one of the main pillars of the Swiss economy in 2021. Along the entire value chains of insurers and banks with their 230,600 full-time positions, a gross value added of CHF 66.7 billion resulted. Insurers accounted for around 40 percent of this. The study conducted by BAK Economics thus shows that the financial sector remains one of the most productive industries in the Swiss economy in 2021.

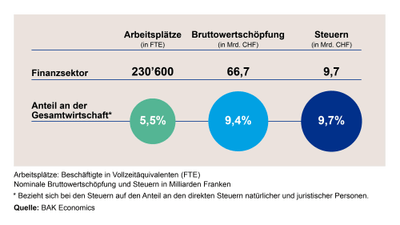

Companies in the financial sector provide a wide range of services, such as risk protection and the supply of money to private individuals and companies, which are essential for a functioning national economy. In 2021, the 230,600 employees of insurers and banks generated gross value added amounting to 66.7 billion Swiss francs. This means that 5.5 percent of jobs in Switzerland were directly attributable to the financial sector. In terms of gross value added, the share in the overall economy is significantly higher at 9.4 percent, which can be attributed to the above-average job productivity. As a result of the direct taxation of employee income and profits in the financial sector, the Confederation, cantons and municipalities recorded fiscal revenues amounting to 9.7 billion Swiss francs. This corresponds to 9.7 percent of the tax revenue in Switzerland resulting from the direct taxation of individuals and legal entities.

Fig. 1 : The direct economic effects of the financial sector in 2021

The financial sector as stimulator for other sectors

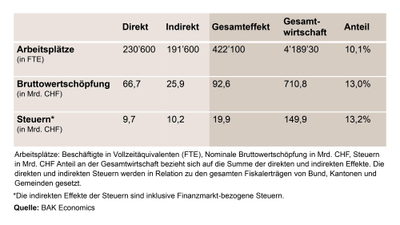

Due to the economic interdependence, companies from other industries also benefit from the activities of insurers and banks. For example, the demand for intermediate services such as for IT or consulting services leads to orders for companies along the entire upstream value chain. In addition, trade and commerce in particular benefit from the consumer spending by employees. Taking such effects into account, the financial sector generated additional gross value added of 25.9 billion Swiss francs in 2021. Overall, 92.6 billion Swiss francs or more than one in eight francs of value added is thus associated with financial sector activities.

Due to these multiplier effects, every 100 jobs in the financial sector result in 83 additional jobs in other Swiss industries. As a result, a total of more than 422,000 jobs in the Swiss economy are attributable to activities in the financial sector.

Furthermore, the financial sector generates substantial fiscal revenues for the public sector. Taxes levied by the Confederation, cantons and municipalities that were directly or indirectly linked to the financial sector, including financial market-related taxes, amounted to an estimated 19.9 billion Swiss francs in 2021. This corresponds to more than 13 percent of Switzerland's total fiscal revenues.

Fig. 2: Direct and indirect economic effects of the financial sector in 2021

Increased demands on the educational level of employees

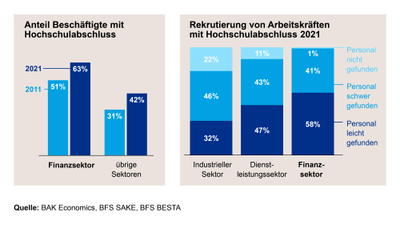

The latest study on the importance of the Swiss financial sector focused on the industry's professionals. Their level of education is above average compared withother sectors: In 2021, six out of ten employees in the financial sector had a university degree. In the other sectors of the Swiss economy, this proportion was significantly lower at 42 percent. It should be noted that between 2011 and 2021, the overall proportion of employees with a tertiary education in Switzerland generally increased significantly.

The (international) competition for labor force makes the recruitment of individuals with a tertiary degree challenging. On average, however, companies in the financial sector find it easier to fill their vacancies than those in the rest of the service sector or industry.

Fig. 3: Skilled workforce in the financial sector

Influence of opposing developments on growth forecast

In the current year 2022, the economy is characterized by opposing developments: the lifting of pandemic measures, the Ukraine war, inflation and problems with global supply chains. Due to strong catch-up effects, the Swiss economy will grow at an above-average rate overall in 2022 (2.1 percent). For 2023, stagnating development (0.2 percent) is expected, among other things due to energy shortages and losses in purchasing power.

BAK Economics forecasts that Swiss insurers will record stable growth in value added despite higher claims payments due to inflation – and expects stable growth of 1.4 percent for both 2022 and 2023. In subsequent years through 2027, insurers are expected to continue to drive growth thanks to general economic and population growth and are projecting average annual growth of 2.1 percent.

About the study

The study on the economic significance of the Swiss financial sector, compiled by BAK Economics, is published annually in November. It is commissioned by the Swiss Insurance Association (SIA) and the Swiss Bankers Association (SBA). The focus is on the most important key figures relating to the financial sector, such as value added, jobs and tax revenue.